TITLE

Public v private insurance coverage for new drugs in Canada, 2018-2023, 7th Edition

CONTRIBUTORS

Brett J Skinner, PhD, Canadian Health Policy Institute (CHPI)

ATTRIBUTION

This paper is corporately authored and edited based on proprietary template models and methods that are intended to facilitate regular updates. The design and content are a cumulative reflection of the diverse contributions collectively attributable to the CHPI affiliated researchers who may have variously participated in updating each edition. Data sources, methods and editorial presentation may evolve from previous editions.

DISCLAIMER

This study uses data from IQVIA Inc. The analysis, conclusions and opinions expressed in this paper do not necessarily reflect the views of the data supplier.

CITATION

Canadian Health Policy Institute (CHPI) (2024). Public v private insurance coverage for new drugs in Canada, 2018-2023. Canadian Health Policy, APR 2024. ISSN 2562-9492 https://doi.org/10.54194/DKPO5320 canadianhealthpolicy.com.

COPYRIGHT ©

Canadian Health Policy Institute (CHPI) Inc. All rights reserved. Unauthorized reproduction or distribution of this article in whole or in part is strictly prohibited.

OPEN ACCESS to this article was sponsored by CHPI’s Canadian Access to Innovative Medicines (CA2IM) research program.

[TO ACCESS CHARTS AND TABLES DOWNLOAD THE PDF OF THE ARTICLE]

About the Study

Purpose

The study compares the availability and wait times for insured access to new medicines in public and private drug plans. It identifies causes of limited availability and excessive waits, and it recommends practical policy options.

Focus on New Medicines

Drug insurance should provide financial protection from unexpected and unaffordable costs of accessing necessary medicines. Many prescription drugs are priced low enough (relative to other household expenses) to be affordable as an out-of-pocket expense. New innovative medicines representing the latest treatment advances, first-in-class therapies, or targeted therapies for rare diseases can be expensive and unaffordable without insurance. Therefore, it is important to measure the quality of benefits provided under drug insurance plans according to the coverage of new medicines.

Policy Relevance

The parliamentary cooperation agreement between the federal Liberals and the NDP has revived proposals for a universal single-payer national pharmacare program. The federal government recently announced it would work with the provinces to fund universal prescription drug benefits for contraceptives and diabetes medications. It is the first step toward a national pharmacare program that will replace existing public and private drug plans. The limited scope of coverage in existing public drug plans is indicative of what Canadians can expect from national pharmacare. The results of this study forewarn that national pharmacare will reduce access to new medicines for Canadians currently covered under private plans.

Background

Canada’s Pluralistic Public-Private Drug Insurance System

Canada has a mixed public and private prescription drug insurance system with a universal public safety net for uninsured drug expenses.

Prescription drug insurance is provided in the private sector through a competitive market with multiple corporate and cooperative enterprises. Insurance providers sell various types of coverage primarily to group sponsors like employers. Sponsors can buy pooled insurance or administrative services only. Sponsors typically provide prescription drug coverage as part of a larger package of extended health benefits for things not covered by provincial health plans. About 25.5 million (64%) Canadians, counting beneficiaries and their dependents, have prescription drug coverage under group-sponsored (68%) or individual (32%) private drug plans. The privately insured population includes public sector employees (provincial and federal members of parliament, senators, employees of the provincial, federal, and municipal governments, and employees of publicly funded institutions like universities), private sector employees, retirees in both sectors who have legacy benefits, and post-secondary students who are eligible for benefits through their tuition payments.

Most provincial and territorial governments provide publicly funded benefits for target populations defined by age, income, or disease. Some offer publicly funded coverage on a universal basis with eligibility for prescription drug expenses that exceed progressive income-adjusted deductibles. The federal government provides publicly funded benefits for indigenous peoples. People who fall in the gaps between private and public insurance are protected because every jurisdiction in Canada has publicly funded safety-net programs for out-of-pocket prescription drug expenses exceeding income-adjusted deductibles. People in the lowest income deciles are eligible for public safety-net coverage at zero or very low costs. People in the highest income deciles are covered when prescription drug costs exceed 3% to 7% of family income depending on the jurisdiction. Average out-of-pocket costs are affordable. Statistics Canada data indicate that in every income decile, more is spent by households on tobacco and alcohol than is spent out-of-pocket on prescription drugs.

While the population is universally insured, not all drugs are covered under existing drug benefit plans and programs. If a patient’s prescribed medication is not listed on the formulary, then they are exposed to 100% of the cost as an out-of-pocket expense. The number of new drugs included on formulary varies within and between sectors. Over 80% of private drug plans have open formularies under which new drugs are eligible for reimbursement immediately upon marketing authorization from Health Canada. Other private plans use positive or negative formulary lists. Typically, private drug plans use deductibles and copayments and end up insuring about 80% of prescription costs. Public drug plans typically have positive formulary lists of drugs approved for reimbursement, and they use income-adjusted deductibles and co-pays. Public drug plans also make reimbursement decisions conditional on: health technology assessment (HTA), conducted by the Canadian Agency for Drugs and Technologies in Health (CADTH); and centralized price negotiations through the pan-Canadian Pharmaceutical Alliance (pCPA).

Data and Method

A new medicine (i.e. innovative or patented, drug or pharmaceutical) was defined as a patented prescription drug product (chemical or biologic), categorized as a new active substance (NAS) by Health Canada, and granted marketing authorization for human use in Canada during the calendar years 2018 to 2022. According to Health Canada, a new active substance is a new drug (pharmaceutical or biologic) that contains a medicinal ingredient not previously approved in a drug in Canada and that is not a variation of a previously approved medicinal ingredient.

The study uses the terminology “marketing authorization (MA)” interchangeably with “regulatory approval(s)”. Both terms mean that Health Canada has issued formal permission to sell a new drug. The terminology “formulary listings” is used interchangeably with “insurance coverage” or “reimbursement”.

Insured access to a new medicine was indicated by its inclusion on the formulary of a drug plan. Insurance coverage was deemed to be the only meaningful concept of access because the cost of many pharmaceuticals would be financially unaffordable for most people without the risk pooling associated with private insurance plans or the subsidy associated with publicly funded drug plans.

The availability status was verified, and wait times metrics were calculated, for the same drug across all jurisdictions. The number of formulary listings were calculated from counts of dates posted in the database. The insurance coverage delay was defined as the number of days lapsed between the date of marketing authorization, and the date that the medicine was included on an insurance formulary in the jurisdiction. The delays were calculated by subtracting earlier dates from later dates using the date value function of Microsoft Excel. The federal–provincial formulary data were aggregated at the national level as a simple average observed across all listings, while the numbers for private drug plans were the first recorded experience with a paid claim in any plan. The difference in method was necessary due to the lack of perfectly comparable data.

The submission dates for new drug applications and the effective dates of regulatory approval were obtained by special request from Health Canada for all new active substances that were authorized for marketing from 1 January 2018 to 31 December 2022. Canadian formulary data were separately available for the 11 federal (Non-Insured Health Benefit NIHB) and provincial publicly funded drug plans, and were available collectively in aggregate across private sector drug plans from IQVIA Inc. The data were supplemented and cross-referenced by accessing the publicly available formulary lists from the federal and provincial drug plans and cancer care agencies. Formulary status was assessed current to 31 December 2023 to allow at least one year for formulary listings data to mature. The study excluded radiopharmaceuticals and vaccines.

The data were compiled into CHPI’s Canadian Access to Innovative Medicines Database (CA2IMD). The database includes the brand name, generic name, manufacturer, jurisdictional regulator, submission class (e.g. NAS), biologic/chemical identifier, new drug application date, marketing authorization date for drugs approved by Health Canada, and reimbursement data including first claim date across private sector drug plans, formulary listing dates for each federal and provincial drug plan, and the reimbursement status of each formulary listing. The database is updated annually.

Results

New Drugs Included on Formulary

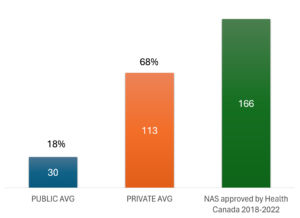

Health Canada reported 166 marketing authorizations for new active substances during 2018-2022. [APPENDIX EXHIBIT 1] Using CHPI’s CA2IM database we counted the total number of formulary listings in each provincial and federal public drug plan, and a comparable total for the private sector drug plans, represented by the first claim reported by any plan for each of the 166 NAS approved by Health Canada. We assumed that the first claim represented the average across most private plans.

CHART 1 shows the average number of formulary listings aggregated across 11 provincial and federal public sector drug plans, and private sector drug plans, also stated as a percentage of the 166 new medicines authorized for marketing by Health Canada from 2018-2022. On average, public drug plans covered only 30 (18%) of the 166 new drugs approved in Canada, compared to 113 (68%) in private drug plans.

In other words, publicly insured Canadians were covered for less than 1 out of every 5 new drugs that Health Canada deemed safe and effective during the study period. By contrast, privately insured Canadians were covered for 3.5 times the number of new drugs available to publicly insured Canadians.

CHART 1. Formulary listings as of 31 DEC 2023 for new active substances approved by Health Canada 2018-2022.

Insurance Coverage Delay

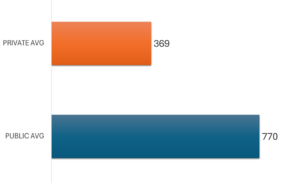

The insurance coverage delay is represented by the time between the date of national marketing authorization and inclusion on a drug plan formulary. CHART 2 shows the average number of days from national marketing authorization to first formulary listing across the federal and provincial drug plans, for the 166 NAS approved by Health Canada during 2018-2022 with a positive formulary listing as of 31 DEC 2023. The corresponding average for private sector drug plans is also shown.

For the few new drugs that were listed, publicly insured Canadians waited over two years on average, from Health Canada approval, for those medicines to be available in their provincial or federal plans. This was twice as long as the average wait times experienced by privately insured Canadians. The data indicate that the insurance coverage delay averaged 770 days across all listings in the 11 provincial and federal public drug formularies. The comparable average wait time for insurance coverage for new medicines in the private sector drug plans was 369 days.

CHART 2. Mean time (days) from marketing authorization to formulary listing as of 31 DEC 2023 for new active substances approved by Health Canada 2018-2022.

Policy Discussion

National Pharmacare

The parliamentary cooperation agreement between the federal Liberals and the NDP has revived proposals for a universal single-payer national pharmacare program. The federal government recently announced it would work with the provinces to fund universal prescription drug benefits for contraceptives and diabetes medications. It is the first step toward a national pharmacare program that will replace existing public and private drug plans.

National pharmacare will entrench the scarcity and delays affecting access to new medicines in federal and provincial drug plans. Our analysis shows that public drug plans listed fewer than one-fifth of all new drugs approved by Health Canada, and the wait for coverage of these few drugs was over 2 years on average. It is unlikely that National pharmacare will cover more new drugs than existing public drug plans. Moreover, 27 million Canadians covered under private plans will experience a significantly diminished drug insurance benefit under a universal single-payer system.

How to Get Better and Faster Coverage Under Public Drug Plans

Coverage of new medicines in private drug plans is better and faster than public drug plans because more than eight out of every 10 private plans have open formularies. Private drug plans also do not utilize health technology assessment (HTA), nor do they engage in the same sort of bureaucratic process for negotiating reimbursement with manufacturers as public plans do. Public drug plans should emulate the open formulary approach practiced by most private drug plans.

However, Canadian pharmaceutical policymakers are unlikely to dismantle the HTA and centralized reimbursement negotiation process. Assuming governments retain the CADTH and the PCPA, these processes should be realigned to occur post market. The German system for pharmaceutical pricing and reimbursement provides an interesting example of this approach that could be adopted in Canada. It is designed to expedite access to new medicines in public drug plans by allowing immediate interim insurance coverage following marketing authorization, with permanent insurance coverage pending the outcome of public reimbursement negotiations. Adopting this approach in Canada’s public drug plans would potentially (pending successful reimbursement) allow beneficiaries of those plans to get access to new medicines with availability and wait times that are comparable to private drug plans with open formularies.

Appendix

EXHIBIT A. Study cohort: 166 new active substances (NAS) authorized for marketing by Health Canada 2018-2022 excluding vaccines and radiopharmaceuticals.

| NAS BRAND NAME | ACTIVE INGREDIENT GENERIC NAME |

| ABECMA | IDECABTAGENE VICLEUCEL |

| ADBRY | TRALOKINUMAB |

| ADDYI | FLIBANSERIN |

| ADTRALZA | TRALOKINUMAB |

| AIMOVIG | ERENUMAB |

| AJOVY | FREMANEZUMAB |

| AKLIEF | TRIFAROTENE |

| ALBRIOZA | URSODOXICOLTAURINE, SODIUM PHENYLBUTYRATE |

| ALUNBRIG | BRIGATINIB |

| ANTHIM | OBILTOXAXIMAB |

| BALVERSA | ERDAFITINIB |

| BELSOMRA | SUVOREXANT |

| BEOVU | BROLUCIZUMAB |

| BESPONSA | INOTUZUMAB OZOGAMICIN |

| BIKTARVY | EMTRICITABINE, TENOFOVIR ALAFENAMIDE HEMIFUMARATE, BICTEGRAVIR SODIUM |

| BIMZELX | BIMEKIZUMAB |

| BRAFTOVI | ENCORAFENIB |

| BREYANZI | LISOCABTAGENE MARALEUCEL |

| BRINEURA | CERLIPONASE ALFA |

| BRUKINSA | ZANUBRUTINIB |

| CABLIVI | CAPLACIZUMAB |

| CABOMETYX | CABOZANTINIB |

| CALQUENCE | ACALABRUTINIB |

| CAMZYOS | MAVACAMTEN |

| CIBINQO | ABROCITINIB |

| CORZYNA | RANOLAZINE |

| CRESEMBA | ISAVUCONAZONIUM SULFATE |

| CRYSVITA | BUROSUMAB |

| DACOGEN | DECITABINE |

| DAURISMO | GLASDEGIB |

| DAYVIGO | LEMBOREXANT |

| DOJOLVI | TRIHEPTANOIN |

| EMGALITY | GALCANEZUMAB |

| EMPAVELI | PEGCETACOPLAN |

| ENHERTU | TRASTUZUMAB DERUXTECAN |

| ENSPRYNG | SATRALIZUMAB |

| ERLEADA | APALUTAMIDE |

| ESPEROCT | ANTIHEMOPHILIC FACTOR VIII (RECOMBINANT, B-DOMAIN TRUNCATED), PEGYLATED |

| EUCRISA | CRISABOROLE |

| EVENITY | ROMOSOZUMAB |

| EVRYSDI | RISDIPLAM |

| FASENRA | BENRALIZUMAB |

| FOLOTYN | PRALATREXATE |

| GAVRETO | PRALSETINIB |

| GIVLAARI | GIVOSIRAN |

| HEMLIBRA | EMICIZUMAB |

| HYQVIA | HYALURONIDASE (HUMAN RECOMBINANT), IMMUNOGLOBULIN (HUMAN) |

| IBSRELA | TENAPANOR |

| IDHIFA | ENASIDENIB MESYLATE |

| ILUMYA | TILDRAKIZUMAB |

| INCRELEX | MECASERMIN |

| INQOVI | CEDAZURIDINE, DECITABINE |

| INREBIC | FEDRATINIB HYDROCHLORIDE |

| INTRAROSA | PRASTERONE |

| JEMPERLI | DOSTARLIMAB |

| JIVI | ANTIHEMOPHILIC FACTOR (RECOMBINANT, B-DOMAIN DELETED, PEGYLATED) |

| KERENDIA | FINERENONE |

| KIMMTRAK | TEBENTAFUSP |

| KISQALI | RIBOCICLIB SUCCINATE |

| KORSUVA | DIFELIKEFALIN |

| KOSELUGO | SELUMETINIB SULFATE |

| KYMRIAH | TISAGENLECLEUCEL |

| LEQVIO | INCLISIRAN SODIUM |

| LIBTAYO | CEMIPLIMAB |

| LIVTENCITY | MARIBAVIR |

| LOKELMA | SODIUM ZIRCONIUM CYCLOSILICATE |

| LONSURF | TIPIRACIL HYDROCHLORIDE, TRIFLURIDINE |

| LORBRENA | LORLATINIB |

| LUMAKRAS | SOTORASIB |

| LUXTURNA | VORETIGENE NEPARVOVEC |

| MAYZENT | SIPONIMOD |

| MEKTOVI | BINIMETINIB |

| MONJUVI | TAFASITAMAB |

| MOUNJARO | TIRZEPATIDE |

| MYLOTARG | GEMTUZUMAB OZOGAMICIN |

| NERLYNX | NERATINIB MALEATE |

| NEXTSTELLIS | DROSPIRENONE, ESTETROL MONOHYDRATE |

| NEXVIAZYME | AVALGLUCOSIDASE ALFA |

| NGENLA | SOMATROGON |

| NUBEQA | DAROLUTAMIDE |

| ODOMZO | SONIDEGIB |

| OLUMIANT | BARICITINIB |

| ONPATTRO | PATISIRAN SODIUM |

| ONSTRYV | SAFINAMIDE |

| ORILISSA | ELAGOLIX |

| ORLADEYO | BEROTRALSTAT HYDROCHLORIDE |

| OSPHENA | OSPEMIFENE |

| OXERVATE | CENEGERMIN |

| OXLUMO | LUMASIRAN SODIUM |

| OZEMPIC | SEMAGLUTIDE |

| PADCEV | ENFORTUMAB VEDOTIN |

| PALYNZIQ | PEGVALIASE |

| PANHEMATIN | HEMIN |

| PEMAZYRE | PEMIGATINIB |

| PIFELTRO | DORAVIRINE |

| PIQRAY | ALPELISIB |

| POLIVY | POLATUZUMAB VEDOTIN |

| PONVORY | PONESIMOD |

| POTELIGEO | MOGAMULIZUMAB |

| QINLOCK | RIPRETINIB |

| QULIPTA | ATOGEPANT |

| RADICAVA | EDARAVONE |

| RAYALDEE | CALCIFEDIOL |

| REBLOZYL | LUSPATERCEPT |

| REKOVELLE | FOLLITROPIN DELTA |

| RETEVMO | SELPERCATINIB |

| RHOLISTIQ | BELUMOSUDIL MESYLATE |

| RINVOQ | UPADACITINIB |

| ROZLYTREK | ENTRECTINIB |

| RUKOBIA | FOSTEMSAVIR TROMETHAMINE |

| RUZURGI | AMIFAMPRIDINE |

| RYBREVANT | AMIVANTAMAB |

| SAPHNELO | ANIFROLUMAB |

| SARCLISA | ISATUXIMAB |

| SCEMBLIX | ASCIMINIB HYDROCHLORIDE |

| SILIQ | BRODALUMAB |

| SKYRIZI | RISANKIZUMAB |

| SOHONOS | PALOVAROTENE |

| SOTYKTU | DEUCRAVACITINIB |

| STEGLATRO | ERTUGLIFLOZIN |

| SUNLENCA | LENACAPAVIR SODIUM |

| SUNOSI | SOLRIAMFETOL HYDROCHLORIDE |

| SYMDEKO | IVACAFTOR, TEZACAFTOR |

| TABRECTA | CAPMATINIB HYDROCHLORIDE |

| TAKHZYRO | LANADELUMAB |

| TALZENNA | TALAZOPARIB |

| TAVALISSE | FOSTAMATINIB DISODIUM |

| TAVNEOS | AVACOPAN |

| TECARTUS | BREXUCABTAGENE AUTOLEUCEL |

| TEGSEDI | INOTERSEN SODIUM |

| TEPMETKO | TEPOTINIB HYDROCHLORIDE |

| TEZSPIRE | TEZEPELUMAB |

| TIBELLA | TIBOLONE |

| TOMVI | ETOMIDATE |

| TRIFERIC AVNU | FERRIC PYROPHOSPHATE CITRATE |

| TRIKAFTA | ELEXACAFTOR, IVACAFTOR, TEZACAFTOR |

| TRODELVY | SACITUZUMAB GOVITECAN |

| TRULANCE | PLECANATIDE |

| TRUSELTIQ | INFIGRATINIB PHOSPHATE |

| TUKYSA | TUCATINIB |

| UBRELVY | UBROGEPANT |

| ULTOMIRIS | RAVULIZUMAB |

| UNITUXIN | DINUTUXIMAB |

| VABYSMO | FARICIMAB |

| VASCEPA | ICOSAPENT ETHYL |

| VELPHORO | SUCROFERRIC OXYHYDROXIDE |

| VELTASSA | PATIROMER SORBITEX CALCIUM |

| VERZENIO | ABEMACICLIB |

| VITRAKVI | LAROTRECTINIB |

| VIZIMPRO | DACOMITINIB |

| VRAYLAR | CARIPRAZINE HYDROCHLORIDE |

| VYEPTI | EPTINEZUMAB |

| VYNDAQEL | TAFAMIDIS MEGLUMINE |

| VYZULTA | LATANOPROSTENE BUNOD |

| WAKIX | PITOLISANT HYDROCHLORIDE |

| WELIREG | BELZUTIFAN |

| XENLETA | LEFAMULIN ACETATE |

| XERMELO | TELOTRISTAT ETIPRATE |

| XOSPATA | GILTERITINIB FUMARATE |

| XPOVIO | SELINEXOR |

| XYDALBA | DALBAVANCIN |

| YESCARTA | AXICABTAGENE CILOLEUCEL |

| ZEJULA | NIRAPARIB |

| ZEPOSIA | OZANIMOD HYDROCHLORIDE |

| ZEPZELCA | LURBINECTEDIN |

| ZOLGENSMA | ONASEMNOGENE ABEPARVOVEC |

References

- Health Canada (2023). PDD, BRDD Annual Performance Reports 2022. https://www.canada.ca/en/health-canada/services/drugs-health-products/reports-publications/drug-products.html.

- IQVIA Inc. Integrated Market Access Console (IMAM) Database. 31 DEC 2023.

- OECD (2018). Pharmaceutical Reimbursement and Pricing in Germany. Organisation for Economic Cooperation and Development.