Why would Canada have the longest wait times for an Alzheimer’s treatment among the G7 countries?

Soeren Mattke, MD DSc, University of Southern California, Los Angeles, USA

Mo Wang, MS, University of Southern California, Los Angeles, USA

ABSTRACT: Background: The emerging disease-modifying Alzheimer’s treatments present a health system challenge because of the combination of a large prevalent patient pool and a complex diagnostic process. Analyses of system preparedness have projected Canada to have the longest and most protracted wait times for access among G7 countries. Methods: Policy analysis study using comparative health system data and 17 semi-structured interviews with experts in Canada. Results: Compared to other G7 countries, Canada has a high number of family physicians, but low numbers of dementia specialists and imaging equipment per capita, leading to wait times even today. The capacity constraints result from limited investment in infrastructure and deliberate use of supply side restrictions for cost containment. Several options exist to alleviate those constraints in the short run, such as building on existing primary-led memory care models, more flexible use of existing imaging devices, and utilization of novel diagnostic technology like digital and blood-based biomarker tests. Conclusions: Canada faces a unique challenge to make a disease-modifying Alzheimer’s treatment accessible because of limited capacity for memory care. While opportunities exist to improve access, they are not likely to be realized fast enough in the absence of a deliberate planning effort.

SUBMITTED: January 10, 2022 | PUBLISHED: January 31, 2022

DISCLOSURE: The work was funded by a contract from Roche Canada to the University of Southern California. The sponsor had no role in the design of the study, interpretation of the findings and decision to submit for publication. Soeren Mattke serves on the board of directors of Senscio Systems, Inc., and the scientific advisory board of AiCure Technologies, and Boston Millennia Partners. He has received consulting fees from AARP, Biogen, Biotronik, Bristol-Myers Squibb, C2N, Defined Health and Roche. Mo Wang reports no potential conflicts.

CITATION: Mattke, Soeren and Wang, Mo (2022). Why would Canada have the longest wait times for an Alzheimer’s treatment among the G7 countries? Canadian Health Policy, January 2022. ISSN 2562-9492, https://doi.org/10.54194/AKQT5456, www.canadianhealthpolicy.com.

BACKGROUND

The first new Alzheimer’s treatment in decades was approved in the U.S. in June 2021. The treatment, aducanumab, is a monoclonal antibody that binds to and removes beta-amyloid deposits in the brain that are assumed to play an important role in the disease process. If used in early stages of the disease, it is expected to reduce disease progression and delay loss of cognition and function [1]. While offering new hope to affected patients and their loved ones, the drug (and others similar to it) presents a challenge to health systems because of the combination of a large prevalent patient pool and a complex diagnostic process.

Patients, in whom cognitive decline is suspected because of a subjective memory complaint or findings during an office visit for other reasons, have to undergo formal neurocognitive testing by a specialist to confirm and quantify the decline and to determine that the patient is still early enough in the disease process for the drug to be effective. Subsequently, biomarker testing with PET scan and/or examination of cerebrospinal fluid is needed to ascertain Alzheimer’s disease as the underlying pathology.

An estimated 1.4 million Canadians today have Mild Cognitive Impairment (MCI), which is the stage at which they would become eligible for treatment, and most have not been identified and evaluated so far [2]. Thus, a large number of patients would need to undergo a fairly complex diagnostic process when the treatment becomes available first. It is important to avoid wait times for receiving a diagnosis, because the disease might progress in the meantime to a stage at which the treatment is no longer effective.

A 2019 study had looked at the preparedness of the Canadian healthcare system to handle the projected caseload, and projected substantial wait times for treatment, with up to half a million Canadians estimated to progress to manifest dementia while on wait lists [2]. Similar studies in other high-income countries have pointed to capacity constraints as well, albeit not to the same degree as in Canada [3] [4] [5]. As FIGURE 1 shows, Canada is projected to have the longest and most protracted wait times for access to a disease -modifying Alzheimer’s treatment among the G7 countries.

| FIGURE 1: Average wait times for a disease-modifying Alzheimer’s treatment in G7 countries

Adapted from [3], [4], [2], [5]. Copyright University of Southern California, reproduced with permission |

The current study takes a comparative policy analysis approach to understand why Canada might have those higher wait times than her high-income peers and to identify solutions to reduce wait times.

METHODS

The study used a literature review to compare capacity for diagnosis and treatment of Alzheimer’s disease in G7 countries based on websites of national (e.g., Statistics Canada) and multilateral (e.g., OECD) organizations and specialty societies that publish health system capacity data as well as research published in peer-reviewed journals and technical reports. The findings were complemented by 17 semi-structured interviews with policy experts, clinical and health services researchers, clinicians and payer representatives in Canada. As the study did not constitute human subjects research per U.S. federal regulations (45 CFR 46, 102(f)) [6] , it was exempt from IRB review and registration.

RESULTS

Comparative healthcare capacity

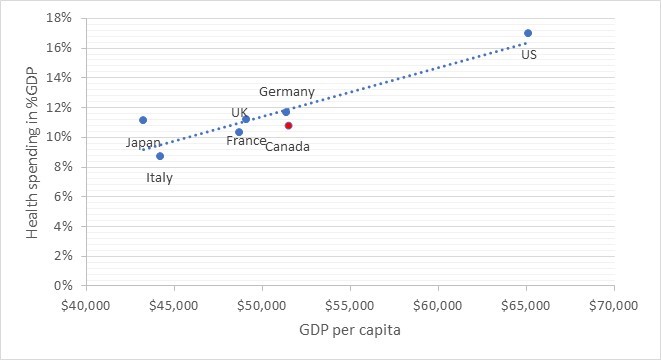

As FIGURE 2 shows, Canada has the second highest GDP per capita among the G7 countries and – with around 11 percent – spends a share of GDP on health that is similar to countries with comparable wealth, like France, Germany and the U.K.

| FIGURE 2: Health spending and per capita GDP in G7 countries

Source: OECD Health Statistics [7], GDP expressed in USD using current Purchasing Power Parity |

With 1.28 per 1,000 population, Canada has the second highest number of primary care physicians after France (1.53) and about four times as many as the U.S. (0.31) [7]. However, with 4.9 per 100,000 population, Canada has the lowest number of dementia specialists (neurologists, geriatricians, and geriatric psychiatrists) among G7 countries as TABLE 1 illustrates. For comparison, Germany and Italy have the five- and threefold, respectively, number of specialists per 100,000 population. While we could not identify population-level data on wait times for dementia specialist consultations, expert opinion puts them at about three to six months, which is consistent with several publications. Based on medical record review, Liddy et al. estimated a median wait time of 96 days for a neurologist appointment in Ontario [8]. Another study covering primary care clinics across Canada reported median wait times of 89 and 105 days for psychiatry and neurology, respectively [9]. Experts also pointed out that in this vast and diverse country, access to specialty care may vary substantially by location. For example, one publication reported median wait times for geriatricians of as high as between 21 and 32 months in rural southern Ontario. [10] Canada also has a relatively low number of hospital beds per capita.

A similar picture emerges for imaging capacity (TABLE 1). Of the G7 countries, only the U.K. has fewer MRI and PET scanners per capita than Canada. [7] Even today, Canadians have to wait on average 10.8 months for an elective MRI scan and as much as 24 months in British Columbia. [11] In addition, we learned in our interviews that Canadians are very reluctant to undergo lumbar punctures, which limits the use of more scalable CSF testing for confirmatory biomarker testing. Consistent with data reported by Laforce et al. [12]. our experts estimated that only around 20% of patients would be diagnosed based on CSF testing, whereas the number is as high as 90% in European countries. While the U.K. has fewer PET scanners per capita than Canada, greater acceptability of lumbar puncture is projected to avoid long wait times for biomarker testing.

TABLE 1: Comparison of healthcare infrastructure in G7 countries

Source: [3], [4], [2], [5] for dementia specialists, OECD Health Statistics [7] for remaining data. Japan does not report the number of family physicians. |

Reasons for capacity constraints

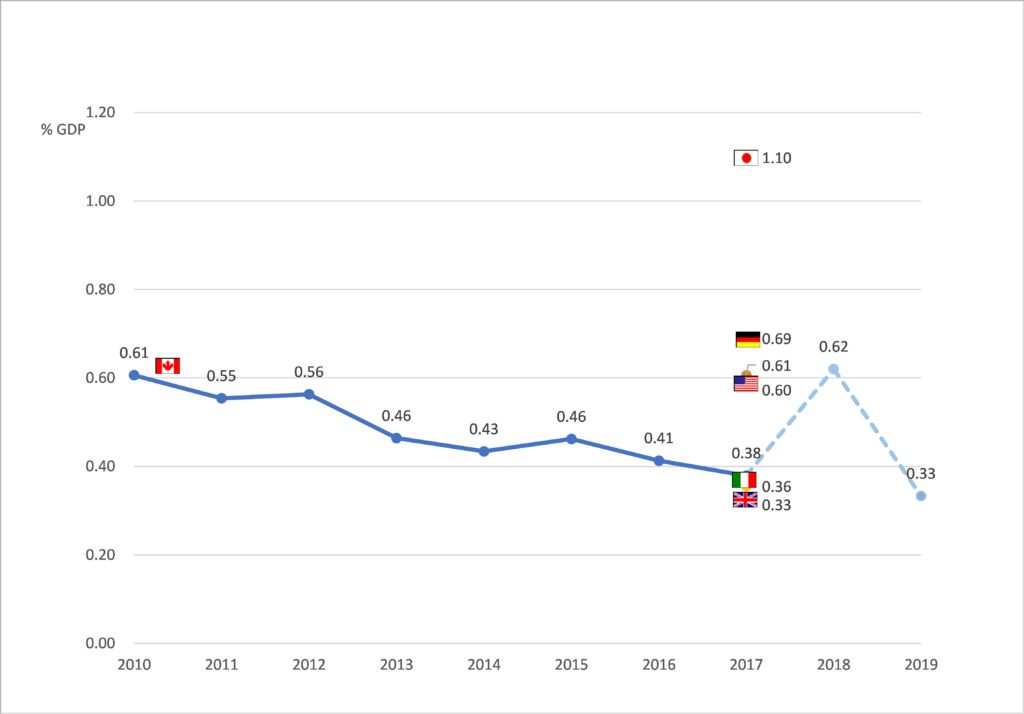

The substantial capacity constraints appear surprising in light of Canada’s wealth and overall high spending on health, as shown in FIGURE 2. An important reason for these constraints is that Canada spends less than the OECD average on gross capital formation relative to GDP, and the share of GDP devoted to investment has declined from 0.61% in 2010 to 0.39% in 2017 [13]. Italy and the U.K. are the only G7 countries with similarly low investment levels, while France and Germany invest about twice the share of GDP (FIGURE 3).

In addition to funding levels, a complex approval process for investment decisions contributes to Canada’s comparatively low numbers of imaging equipment and hospital beds. One interviewee remarked that it can take over five years to have new imaging equipment installed in a public hospital even if funding is available.

Our interviewees explained that the spending pattern is explained by two factors. First, the clinical and nonclinical employees in public healthcare facilities tend to be unionized and have substantial political influence in a province because of their large numbers. Thus, their pay and benefits levels usually escape budget cuts whereas deferring investment is politically more palatable. Second, physicians remain largely independent practitioners and three-quarters of their remuneration is on a fee-for-service basis [14]. While Canada regulates prices for medical services, there are fewer volume caps or global budgets that would limit overall billing by physicians. For example, German physicians in private practice are paid based on a regulated fee schedule similar to their Canadian peers. However, practices operate functionally under a global budget, as each practice is assigned a revenue target based on location, specialty and panel size. If that target is exceeded, the payment rate for additional services will decline. With limited tools to impose such overall caps, the use of supply side constraints on workforce and physical infrastructure is a critical policy lever to maintain budget discipline in Canadian provinces.

| FIGURE 3: Capital investment in healthcare in G7 countries

Source: OECD [13] |

Challenges in workforce planning contribute to comparatively low numbers of specialists according to our experts. While the Provincial Ministry of Health sets annual targets for the numbers of residency training slots in each specialty, the medical faculty decides how many slots to offer depending on capacity of attendings to train residents and interest of prospective residents in the program. The process commonly leads to lower than targeted enrollment, especially outside of procedural specialties, leaving Canada heavily reliant on physician immigration to fill the gaps. According to OECD data, about a quarter of the workforce is foreign-trained [7]. In other words, Canada underinvests in physical and human capital compared to other high-income countries while having high operational spending.

CONCLUSION

This analysis looked into explanations for Canada having the longest projected wait times among the G7 countries for access to a disease-modifying Alzheimer’s treatment and found supply-side constraints on physical and human capital to be the main cause. Those constraints lead to wait times for elective specialty care even today and leave little room to accommodate such sudden increases in demand as a disease-modifying Alzheimer’s treatment would trigger.

In comparison to volume caps or global budgets, which are commonly used cost containment tools in other countries, supply side constraints award less flexibility to ramp up volume in the short run, as they limit reserve capacity. While we learned that provincial health plans are shifting away from fee-for-service towards alternative payment models, such as capitation and pay-for-performance, in particular for non-procedural specialists and family physicians, changing the long-standing policy of reliance on supply side constraints and its effect on the infrastructure will take time.

Thus, the question arises how Canada can improve access to the treatment within the existing constraints in the short run. On the workforce side, Canadian Family Physicians have always taken on responsibilities that firmly lie in the hands of specialists in many other countries and memory care is no exception. Primary care-led memory services have emerged in several provinces [15] and ongoing efforts to consolidate primary care into larger practices [16] will allow for internal specialization and a greater degree of task shifting to other clinical and non-clinical staff. While promising, these care models would have to evolve considerably to handle a disease-modifying treatment, since their current focus is diagnosis, counseling and referrals to social services rather than the medicalized nature of the treatment with complex differentia diagnosis, biomarker testing, advanced imaging and potentially infusion treatment. Training, additional investment and mostly likely integration with specialty services would be needed to transform those memory clinics into comprehensive outpatient facilities, similar to larger oncology practices.

The most obvious path to reduce wait times for biomarker testing would be greater reliance on CSF testing, which is more scalable and less expensive than PET imaging. The above-mentioned study by Liu et al. had shown that using CSF testing in half of patients would eliminate wait times for confirmatory biomarker testing [2]. Apart from educating patients and clinicians about the safety of lumbar puncture, a shift of this magnitude would require additional training, as few physicians have reportedly maintained facility with this procedure for lack of demand.

In addition, additional imaging capacity can be recruited from two sources. First, several academic medical centers have so-called research devices, which were bought from donations and grants and may not be used for imaging outside of clinical trials or studies. Second, private practices are operating scanners for imaging outside medical coverage under the Health Canada Act, such as for worker’s compensation cases. Provincial authorities could authorize the use of those devices for routine use under their provincial health plan to reduce wait times. Lastly, some provinces, such as Alberta, are experimenting with public-private partnerships to expand capacity. Under those arrangements, private companies provide capital to build facilities in exchange for long-term contracts for services. [17]

A technologic breakthrough that could create a path to creating sufficient testing capacity in Canada is the introduction of a blood-based biomarker for the Alzheimer’s pathology. A recent study has shown that a fully automated blood test for beta-amyloid [18] achieves levels of sensitivity and specificity that allows using it as a triage tool in the evaluation process of patients with cognitive decline. A subsequent analysis projected that the combination of this blood test with a brief cognitive exam, both of which can be performed in primary care settings, in patients with suspected MCI can reduce the need for subsequent cognitive and confirmatory biomarker testing by 30% [19]. While not yet established as an automated test, a plasma phospho-tau assay has demonstrated to distinguish Alzheimer’s disease from other causes of cognitive impairment and to allow prediction of progression risk. [20] Digital biomarkers are being explored for case finding and differential diagnosis as well. [21]

To summarize, Canada faces a disproportionate challenge in making a disease-modifying Alzheimer’s treatment accessible, putting an estimated half million of her residents at risk of progressing to moderate or severe dementia while on wait lists. At the same time, a strong and innovative primary care system combined with emerging technologies would allow alleviating obstacles by optimizing triage and patient flows without requiring fundamental structural changes in the short run. It should be kept in mind, however, that such novel care models will not or not quickly enough evolve organically. Federal and provincial planners and professional societies will need to come together in a concerted effort to affect change.

REFERENCES

- Haeberlein SB vHC, Tian Y, Chalkias S, KandadiMK, Chen T, Wu S, Li J, SkordosL, Nisenbaum L, Rajagovindan R, Dent G, Harrison K, Nestorov I, Zhu Y, Mallinckrodt C, Sandrock A. . EMERGE and ENGAGE Topline Results: Two Phase 3 Studies to Evaluate Aducanumab in Patients With Early Alzheimer’s Disease. . Clinical Trials on Alzheimer’s Disease 12/7/2019; San Diego, CA2019.

- Liu JL, Hlavka JP, Coulter DT, et al. Assessing the Preparedness of the Canadian Health Care System Infrastructure for an Alzheimer’s Treatment. RAND Corporation; 2019.

- Liu JL, Hlávka JP, Hillestad R, et al. Assessing the Preparedness of the U.S. Health Care System Infrastructure for an Alzheimer’s Treatment. Santa Monica, CA: RAND Corporation; 2017.

- Hlavka JP, Mattke S, Liu JL. Assessing the Preparedness of the Health Care System Infrastructure in Six European Countries for an Alzheimer’s Treatment. Rand health quarterly. 2019 May;8(3):2. PubMed PMID: 31205802; PubMed Central PMCID: PMCPMC6557037. eng.

- Mattke HJ, Yoong J, Wang M, Goto R. Assessing the Preparedness of the Japanese Health Care System Infrastructure for an Alzheimer’s Treatment. CESR Reports. Los Angeles, CA: USC; 2019.

- Human Subject Regulations Decision Charts, 45 CFR 46, 102(f) (2016).

- OECD Health Statistics: 2021. Available from: https://stats.oecd.org/index.aspx?DataSetCode=HEALTH_STAT&_ga=2.50602665.1027904789.1547669784-346925670.1543585491#. accessed January 13, 2022

- Liddy C, Nawar N, Moroz I, et al. Understanding Patient Referral Wait Times for Specialty Care in Ontario: A Retrospective Chart Audit. Healthcare Policy | Politiques de Santé. 2018;13(3):59-69. doi: 10.12927/hcpol.2018.25397.

- Liddy C, Moroz I, Affleck E, et al. How long are Canadians waiting to access specialty care? Retrospective study from a primary care perspective. Canadian family physician Medecin de famille canadien. 2020;66(6):434-444. PubMed PMID: 32532727; eng.

- Lee L, Hillier LM, McKinnon Wilson J, et al. Effect of Primary Care-Based Memory Clinics on Referrals to and Wait-Time for Specialized Geriatric Services. Journal of the American Geriatrics Society. 2018;66(3):631-632. doi: 10.1111/jgs.15169.

- Barua B, Moir M. Waiting Your Turn: Wait Times for Health Care in Canada, 2019 Report. Fraser Institute; 201912. Laforce R, Rosa-Neto P, Soucy J-P, et al. Canadian Consensus Guidelines on Use of Amyloid Imaging in Canada: Update and Future Directions from the Specialized Task Force on Amyloid imaging in Canada. Canadian Journal of Neurological Sciences / Journal Canadien des Sciences Neurologiques. 2016;43(4):503-512. doi: 10.1017/cjn.2015.401.

- OECD. Capital expenditure in the health sector. 2017.

- Canadian Institute for Health Information. Physicians in Canada, 2018. 2019.

- Lee L, Hillier LM, Heckman G, et al. Primary Care-Based Memory Clinics: Expanding Capacity for Dementia Care. Canadian journal on aging = La revue canadienne du vieillissement. 2014 Sep;33(3):307-19. doi: 10.1017/s0714980814000233. PubMed PMID: 25111053; eng.

- Hutchison B, Levesque J-F, Strumpf E, et al. Primary health care in Canada: systems in motion. Milbank Q. 2011;89(2):256-288. doi: 10.1111/j.1468-0009.2011.00628.x. PubMed PMID: 21676023; eng.

- Hardcastle L, Ogbogu U. Unhealthy reforms: The dangers of Alberta’s plan to further privatize health-care delivery 2020. Available from: https://theconversation.com/unhealthy-reforms-the-dangers-of-albertas-plan-to-further-privatize-health-care-delivery-144443

- Palmqvist S, Janelidze S, Stomrud E, et al. Performance of Fully Automated Plasma Assays as Screening Tests for Alzheimer Disease-Related beta-Amyloid Status. JAMA Neurol. 2019 Jun 24. doi: 10.1001/jamaneurol.2019.1632. PubMed PMID: 31233127; PubMed Central PMCID: PMCPMC6593637.

- Mattke S, Cho SK, Bittner T, et al. Blood-based biomarkers for Alzheimer’s pathology and the diagnostic process for a disease-modifying treatment: Projecting the impact on the cost and wait times. Alzheimers Dement (Amst). 2020;12(1):e12081. doi: 10.1002/dad2.12081. PubMed PMID: 32832590; PubMed Central PMCID: PMCPMC7434228.

- Janelidze S, Mattsson N, Palmqvist S, et al. Plasma P-tau181 in Alzheimer’s disease: relationship to other biomarkers, differential diagnosis, neuropathology and longitudinal progression to Alzheimer’s dementia. Nature Medicine. 2020;26(3):379-386. doi: 10.1038/s41591-020-0755-1.

- Buegler M, Harms RL, Balasa M, et al. Digital biomarker‐based individualized prognosis for people at risk of dementia. Alzheimer’s & Dementia: Diagnosis, Assessment & Disease Monitoring. 2020;12(1). doi: 10.1002/dad2.12073.